Twinkies: A $410 Million Dollar Business

Thursday, January 31, 2013 at 7:01PM

Thursday, January 31, 2013 at 7:01PM The Twinkies brand goes up for bid.

Might it be worth $410 million.

A good read:

http://money.msn.com/business-news/article.aspx?feed=AP&date=20130131&id=16062626

Based in Atlanta, GA - Rick Limpert is an award-winning writer, a best-selling author, and a featured sports travel writer.

Named the No. 1 Sports Technology writer in the U.S. on Oct 1, 2014.

Thursday, January 31, 2013 at 7:01PM

Thursday, January 31, 2013 at 7:01PM The Twinkies brand goes up for bid.

Might it be worth $410 million.

A good read:

http://money.msn.com/business-news/article.aspx?feed=AP&date=20130131&id=16062626

Friday, August 10, 2012 at 9:18AM

Friday, August 10, 2012 at 9:18AM He's a hot artist on Americana stations across the country and I enjoyed interviewing him back in the spring.

I'm talking about Paul Thorn and many of his great albums are $5 today on Amazon.

Check them all out, but "What The Hell is Goin' On" is fantastic.

Friday, November 25, 2011 at 2:27PM

Friday, November 25, 2011 at 2:27PM Can't see this happening in the States, but the race for Blackberries was evidently similar to the running of the bulls yesterday in Indonesia.

Dozens of people suffered minor injuries as many hundreds of impatient BlackBerry fans broke through a barricade to get their hands on the latest smartphone during a discount promotion in a Jakarta mall on Friday.

As the crowd swelling to well in excess of a thousand people — a number of whom had been queuing since the previous day — rumors began circulating on Friday morning that the BlackBerry Bellagio, also known as a BlackBerry Bold 9790, had sold out during the event at Pacific Place mall in South Jakarta.

This and impatience and frustration caused the crowd to surge forward through a barrier that was supposed to hold crowds back.

In the ensuing crush, at least 90 people passed out, while three suffered broken bones. More that 200 security and police were called into to control the crowds.

The good news in all of this, is some people still want to own a Blackberry.

Blackberry,

Blackberry,  RIM,

RIM,  indonesia rush,

indonesia rush,  sale in

sale in  Events,

Events,  Gadgets,

Gadgets,  News,

News,  People

People  Monday, April 25, 2011 at 6:23AM

Monday, April 25, 2011 at 6:23AM

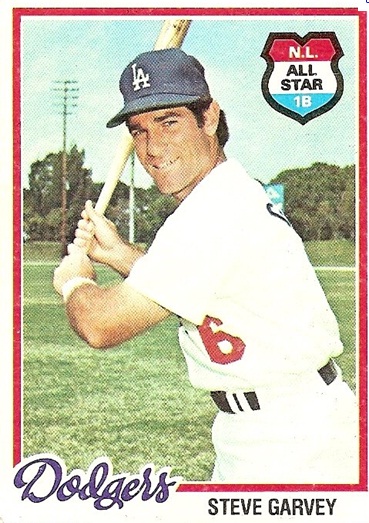

One of the most popular players in Dodgers history, Steve Garvey said Friday that he has teamed with billionaire business magnate Ron Burkle in an investment group that would like to buy the team.

Baseball Commissioner Bud Selig seized control of the Dodgers this week, dramatically increasing the chances the team eventually would be sold. In that event, Garvey said, he believes his baseball background and Burkle's business acumen could help the Dodgers reclaim their place among baseball's elite franchises.

Burkle teamed with franchise icon Mario Lemieux in buying the NHL's Pittsburgh Penguins in 1999; the Penguins won the Stanley Cup in 2009. Burkle has pursued the Pittsburgh Pirates and Washington Nationals in recent years, according to press reports.

Burkle, 58, has a home in Beverly Hills. Forbes estimates his net worth at $3.2 billion. At least two other local billionaires also have been reported to be preparing bids for the Dodgers: developer Alan Casden, who pursued the team when it was last up for sale, and financier Alec Gores, whose brother Tom bought the NBA's Detroit Pistons earlier this month.

Another NBA owner, Mark Cuban of the Dallas Mavericks, previously has expressed interest in the Dodgers. In an email Friday, Cuban declined to say whether he would be interested in the Dodgers — "They aren't for sale," he wrote — but said he had received numerous messages from Dodgers fans in the three days since Selig acted.

"Between tweets and emails, I couldn't count them all," Cuban wrote.

Bud Selig,

Bud Selig,  Burkle,

Burkle,  Los Angeles Dodgers,

Los Angeles Dodgers,  Mark Cuban,

Mark Cuban,  Steve Garvey,

Steve Garvey,  sale in

sale in  News,

News,  People,

People,  Sports

Sports  Sunday, March 20, 2011 at 7:12PM

Sunday, March 20, 2011 at 7:12PM AT&T Inc. said Sunday it will buy T-Mobile USA from Deutsche Telekom AG in a cash-and-stock deal valued at $39 billion that would make it the largest cellphone company in the U.S.

The deal would reduce the number of wireless carriers with national coverage from four to three, and is sure to face close regulatory scrutiny. It also removes a potential partner for Sprint Nextel Corp., the struggling No. 3 carrier, which had been in talks to combine with T-Mobile USA.

AT&T is now the country's second-largest wireless carrier and T-Mobile USA is the fourth largest. The acquisition would give AT&T 129 million subscribers, vaulting it past Verizon Wireless' 102 million. The combined company would serve about 43 percent of U.S. cellphones.

For T-Mobile USA's 33.7 million subscribers, the news doesn't immediately change anything. Because of the long regulatory process, AT&T expects the acquisition to take a year to close. But when and if it closes, T-Mobile USA customers would get access to AT&T's phone line-up, including the iPhone.

With this transaction, AT&T commits to a significant expansion of robust 4G LTE (Long Term Evolution) deployment to 95 percent of the U.S. population to reach an additional 46.5 million Americans beyond current plans – including rural communities and small towns. This helps achieve the Federal Communications Commission (FCC) and President Obama’s goals to connect “every part of America to the digital age.” T-Mobile USA does not have a clear path to delivering LTE.

“This transaction represents a major commitment to strengthen and expand critical infrastructure for our nation’s future,” said Randall Stephenson, AT&T Chairman and CEO. “It will improve network quality, and it will bring advanced LTE capabilities to more than 294 million people. Mobile broadband networks drive economic opportunity everywhere, and they enable the expanding high-tech ecosystem that includes device makers, cloud and content providers, app developers, customers, and more. During the past few years, America’s high-tech industry has delivered innovation at unprecedented speed, and this combination will accelerate its continued growth.”

In a press release, Deutsche Telekom Chairman and CEO René Obermann chimed in.

As we evaluated options for the T-Mobile USA business, two questions were foremost in our minds: what’s best for Deutsche Telekom and what’s best for T-Mobile USA? The transaction with AT&T is the answer to both questions.

The sale of T-Mobile USA to AT&T is the ideal strategic path for Deutsche Telekom as it provides us with the flexibility to invest in our networks across Europe while simultaneously retaining our exposure to the dynamic U.S. wireless industry through an approximately 8% equity stake in AT&T. We believe the transaction values T-Mobile USA appropriately and is in the best interests of our shareholders.

This sale is not only in the best interests of Deutsche Telekom, but is the best and most logical way forward for T-Mobile USA customers. Most importantly, both AT&T and T-Mobile use the same network technology, which will make the integration seamless and produce significant benefits for customers. By itself, T-Mobile USA does not have a clear path to delivering LTE. With the combined spectrum, cell sites and scale, T-Mobile customers will see a tangible improvement in service and fully benefit from the rapid evolution of LTE and the broader mobile ecosystem of innovation.